Commercial Auto

What is Commercial Auto Insurance?

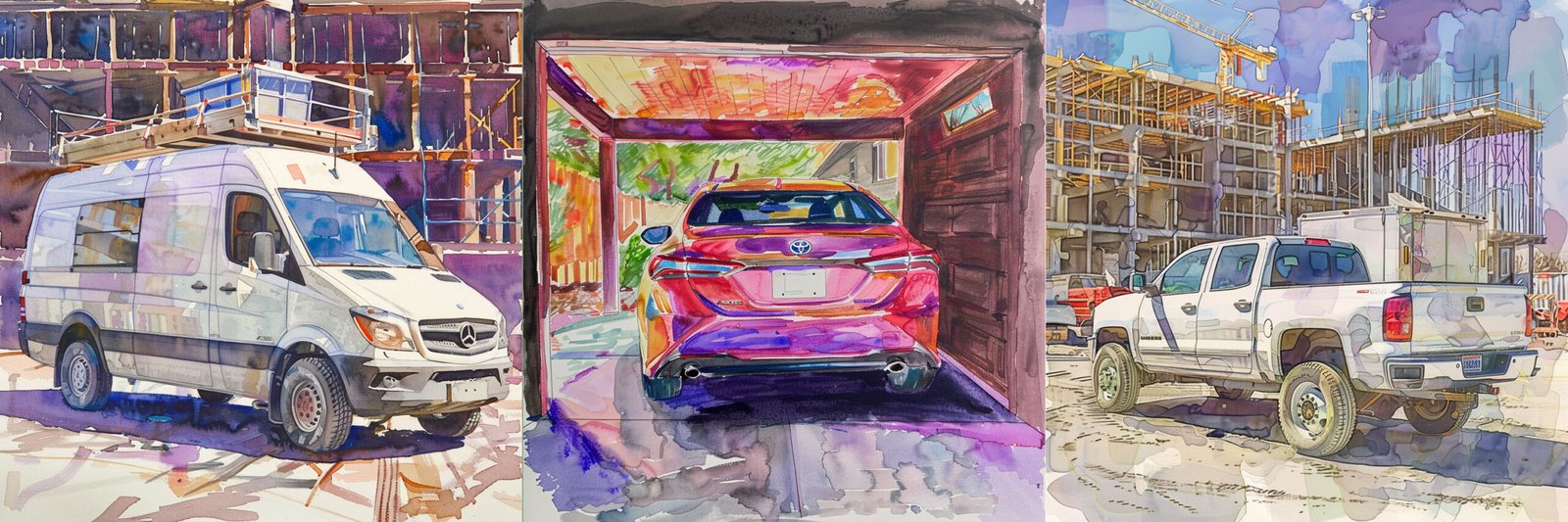

Commercial auto insurance provides coverage for vehicles used for business purposes. This can include cars, trucks, vans, and other vehicles used to transport goods, equipment, or people. It offers protection against physical damage, liability for bodily injury, and property damage resulting from vehicle accidents.

Why is Commercial Auto Insurance Necessary?

Difference Between Personal and Commercial Auto Insurance